MarketingDojo#89: 🤖AI Ate LinkedIn🍴

LinkedIn's AI slop problem, Apple's advertising play, Amazon's really serious reviews and more.

Hello there!

I'm back from my holiday in China—a trip that felt both too short and endlessly memorable.

It was a whirlwind of incredible food and over 20k steps a day. The winter chill had just started to set in Shanghai and Hong Kong. I enjoyed the chill against my face, which I miss at home.

After a year buried in work, this trip reminded me why I need to bookend my years with moments of escape. In Singapore, where holidays feel like rare gems, I'm making an early resolution for 2025: strategic, shorter breaks to recharge and breathe life back into my routine.

Where is the end of the year taking you?

As I brush off my writing muscles, here's what's on the agenda for this week's Marketing Dojo:

🚀 Meme-time: LinkedIn's Self-Goal

🎭 Creative Excellence: Very Serious Customer Reviews

🛍️ Shein and Temu's Thanksgiving Retail Drama

📱 Apple Turns Up the Advertising Heat

And plenty more to unpack!

A quick request before we dive in - If you haven't already, consider subscribing to the Marketing Dojo. Every week, I share the best marketing news with you in an easy-to-read format. Sign up and join the gang!

Meme-Time: The Master of Self-Goals.

Benedict Evans recently released his annual presentation, aptly titled "AI Eats the World." While total AI domination might take time, it is devouring social media platforms—with LinkedIn as its most enthusiastic appetizer.

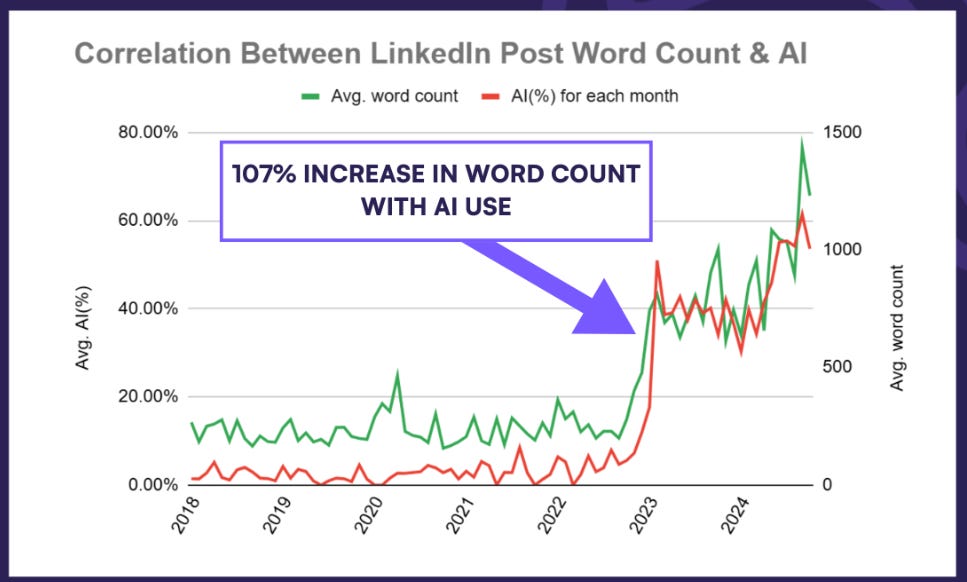

The researchers at Originality.ai conducted a fascinating 82-month analysis of 8,795 posts, and their findings are nothing short of shocking:

As of October 2024, 54% of the long-form posts on LinkedIn analyzed for the study were likely created using AI

The average posts are getting longer, with over a 107% increase in word count correlated to the time in which AI content perpetuated on LinkedIn.

In short, LinkedIn has a significant AI slop problem on its hands. The platform is fueling the fire by providing native AI tools to create long-form posts using prompts.

For B2B marketers, LinkedIn remains the premier platform for meaningful customer engagement. But if the platform doesn't address this AI-generated content flood, it's essentially digging its own professional networking grave—no artificial intelligence required

.

Dragons Crash the Thanksgiving Retail Party.

A shrinking customer base wary of perpetual discounts and new competition driving up the cost of reaching your customers - This Thanksgiving was no fun for American retailers.

This article by PYMNTS highlights some interesting points - Shein and Temu's deep marketing warchest is making life challenging for Walmart, Target, Kohls and more retailers.

For Black Friday, Temu bid on keywords like "Walmart Black Friday deals," "Kohl Black Friday", and "Bed Bath Beyond."

Similarly, Shein bid on keywords such as "Walmart clothes," "Zara jeans," "Mango dresses", and "Nordstrom Rack shoes" in the U.S., the data showed.

The cost of bidding for the generic term "Walmart Clothes" has increased 16-fold in just two years.

What's more, annual shopping events like Black Friday are met with less enthusiastic responses. A fourth of the customers surveyed by Pymnts indicated they would not even be shopping during Black Friday this year.

Overall, Temu and Shein's marketing budgets are large and aggressive.

In 2023, every sale on Temu cost the eCommerce retailer $40. Its 2024 marketing budget, excluding subsidies to its seller, is expected to be between $4.3 billion and $5Bn, of which nearly 50% will be spent on North America.

The ultimate winners in the bloodbath in retail are clearly the platforms, especially Meta, Google and mobile advertising platform Applovin.

Last year, 30% of Meta's advertising revenue came from advertisers in mainland China, making China one of Meta's most important markets.

Meta has listed Temu, Alibaba, ByteDance, and Shein (known in China as 'the four little dragons going overseas') as direct customers.

As Shein and Temu continue their advertising blitz, the question is: Can traditional retailers keep up, or will platforms remain the ultimate beneficiaries of this retail showdown?

Creative Excellence: Where Humor Meets Commerce

Amazon reviews have a cult following—ask the members of the Amazon Reviews Subreddit.

Amazon's marketing team clearly understands this cultural phenomenon—and they're leaning into it with brilliant comedic timing.

Enter their new Thanksgiving ad campaign, Amazon 5-Star Theatre.

In this series of ads, actor Adam Driver delivers dramatic readings of some of the platform's most humorous and iconic five-star reviews, treating them as theatrical monologues.

The campaign features Driver performing reviews for products like a banana slicer, a Dutch oven, and a plush seal. The ads are set in a cosy, festive environment, with Driver seated in front of a Christmas tree and accompanied by a pianist playing holiday tunes.

The genius of this campaign lies in its self-awareness. By treating these over-the-top reviews as legitimate performance pieces, Amazon does something remarkable: it humanizes a massive tech platform.

Who knew product reviews could become prime-time entertainment?

Privacy Meets Profits: Apple's Ad Gambit.

Apple is turning up the heat on its advertising business.

The tech giant is now venturing into direct ad sales for its Apple News platform, marking a significant shift in its strategy. Here's what's happening:

Direct Ad Sales on Apple News

Apple has moved away from third-party vendors and taken control of ad sales for Apple News. Its now offers a variety of ad formats, including in-feed ads, banners, carousel ads & sponsored content.

Publisher revenue sharing.

Under this model, publishers will receive a 70% share of ad revenue generated from ads within their articles. This incentivizes content creators while making Apple News more attractive to advertisers.

Strategic Hires

Apple has built a team of industry veterans to drive its advertising ambitions, poaching talent from companies like NBCUniversal and other media giants.

Why This Move?

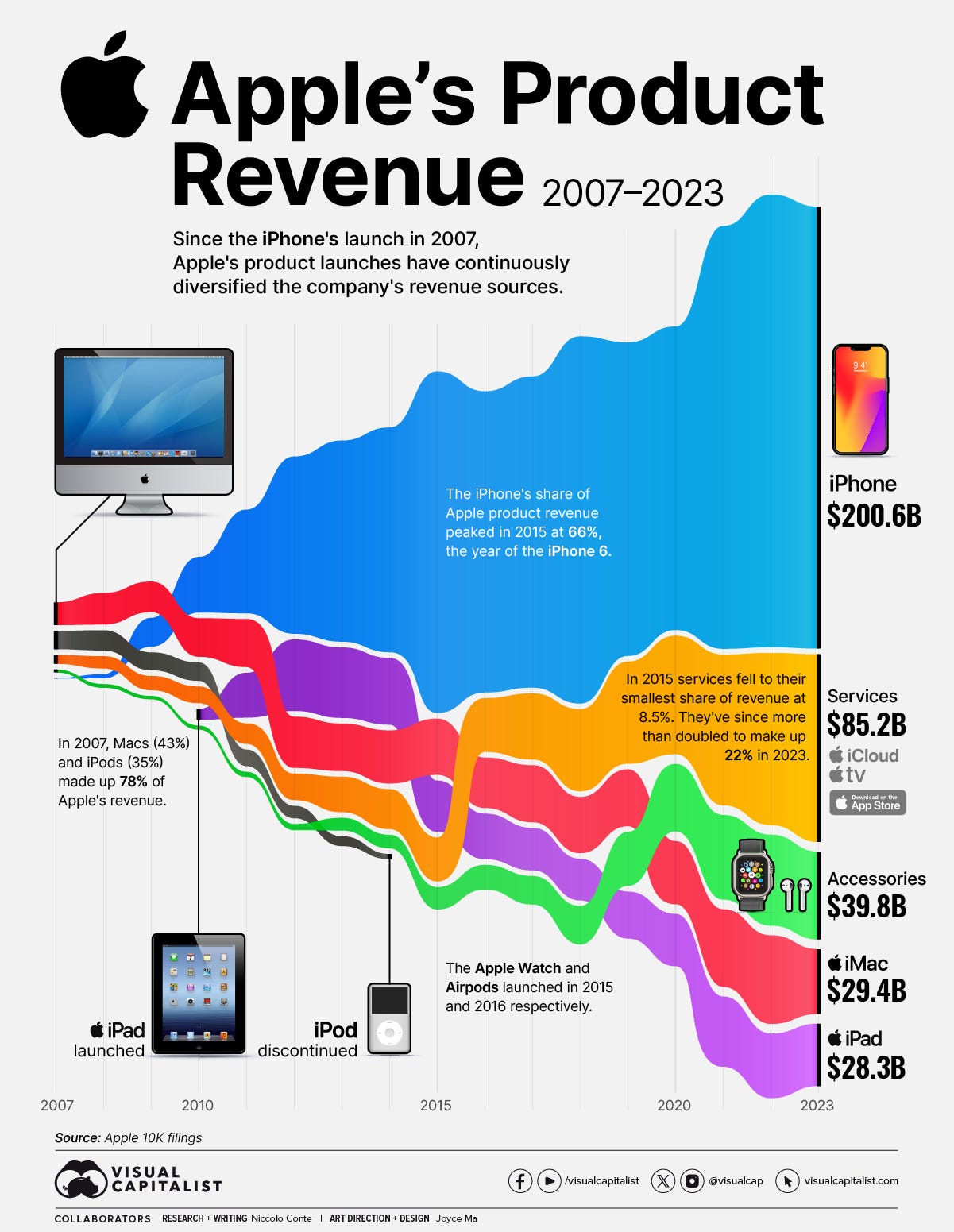

Apple's core revenue streams are shifting:

48.69% of revenue still comes from iPhone sales, but growth is slowing.

In H1 2024, iPhone revenue dropped $2.7 billion year-over-year, totalling $85.2 billion. This decline is attributed to competitors like Xiaomi and Oppo, which offer high-spec devices at lower prices.

Apple's loyal customer base gives it a solid foundation to grow its advertising business, which is typically high-margin and scalable.

What This Means for Marketers

Google, Meta, and Amazon have long dominated the advertising landscape. Apple's entry into direct ad sales will dramatically shake up media spending patterns. With its premium audience and privacy-first positioning, Apple will become a powerful player in the digital ad space.

Marketers take note: the media spend pie is about to get a new slice.

Watch this space for updates.

Short Stuff:

Australia passes the bill to ban social media for those under 16. (Welcome, move this).

40% Of one eCommerce brand’s Google Performance Max ads were served on AI-built, made-for-advertising websites. (Money down the drain).

Reddit overtook X to become the UK's fifth most popular social media platform. (The overnight success that took decades in the making).

That’s a wrap on this week. Thank you for your time and attention. If you liked this week’s newsletter or found something interesting, please give me a like ❤️ or drop a comment🗨️. Your support helps drive the newsletter's discoverability.

See you in your inbox next Wednesday.

Very good analysis, Garima. Just stumbled upon your newsletter and am happy to read more

This is great Garima, I especially love the Adam Driver campaign! I can almost hear him saying, "This banana slicer changed my life,' with the gravitas of Hamlet. And those AI generated posts makes me nostalgic for when people overshared about their pets instead of their KPIs.