Google updates its search quality framework; the digital ad business is no longer a duopoly.

Google's updated E-E-A-T framework, the winners and losers in digital ad sales business and Mastodon's spectacular growth.

Email, social and search are the three primary sources of website traffic.

Working on SEO-optimized websites was a richly rewarding experience for me in 2022.

Within three months of development, a website I worked on ranked for over 200 non-branded keywords and #1 for a couple of top broad match keywords. That's a big win!

Surprisingly, despite tons of content out there, good content for B2B portfolios takes some effort to find.

Creating helpful content is more than just a once-and-done exercise. I will continue with my experiments around web page optimisations and share the results of future experiments here.

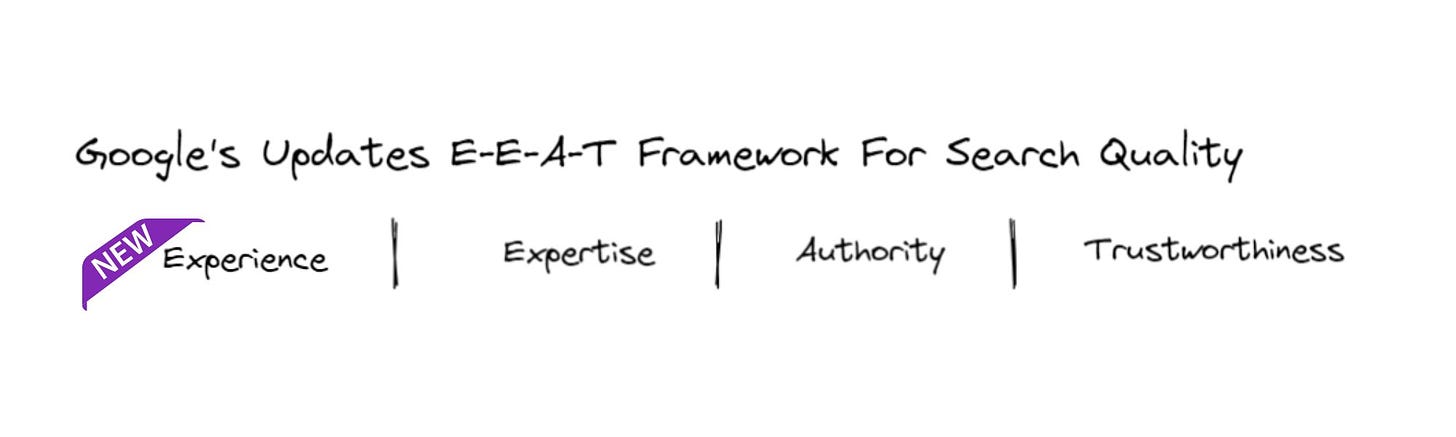

Google updated its E-A-T Framework.

EAT is now EEAT

While choosing which content to work on, Google’s EAT framework (Experience -Authority- Trustworthiness) comes in handy. Last week, Google updated its framework to E-E-A-T or double EAT.

Experience highlights whether the content creator has hands-on experience with the subject they are writing about.

For example, if you are looking for reviews of a car, you would like to see reviews from an actual owner. This is where experience comes into the picture.

Meta and Alphabet are no longer dominating the US digital ad market.

For the first time since 2014, Meta and Alphabet no longer hold more than 50% market share of digital ad sales in the US markets.

As per a study by Insider Intelligence, their market share fell to 48.4% in 2023, the fifth annual decline for the duopoly.

The only way to go is down when you are in a dominant market share position. Competition has caught up in 2023.

Apple’s ad revenues grew from 2.2bn to 7bn, and Apple is making significant people investments in their ad business vertical.

In q3,2022, Amazon reported $9.5Bn in quarterly ad business revenues, up 25% y-o-y.

TikTok is winning in the race for attention. Ad dollars are bound to follow.

Netflix is partnering with Microsoft for its ad-supported membership tier.

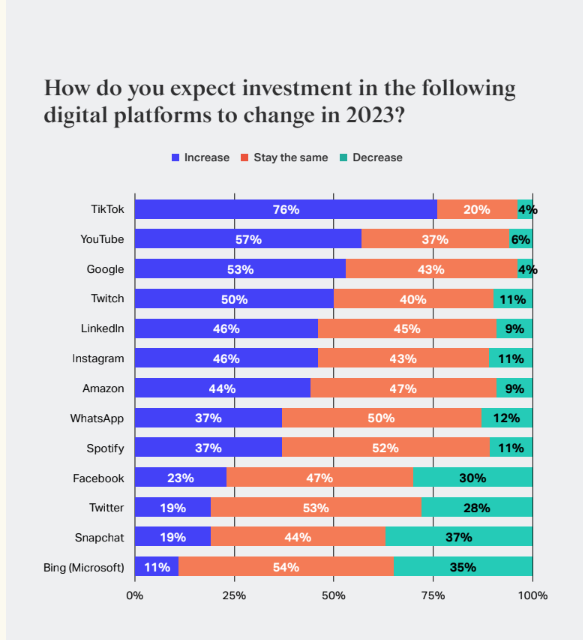

WARC’s report “The Marketer’s Toolkit 2023” findings are consistent with this trend around the diversification of digital media spending. Marketers were asked about their expected spending on each platform for the study.

Facebook, Twitter, Snapchat, and Bing might shrink further in 2023.

With a not-such-a-rosy economic outlook for 2023, the ad revenues might be a zero-sum game. Relatively nascent players such as Netflix and TikTok will gain at the expense of Meta and Google.

However, in the longer run, the competition will provide novel ways to reach ad-weary customers. Over some time, the increased competition will end up growing the overall advertising business multi-fold.

Mastodon: The rise of the Fediverse :

Mastodon - the largest federated social media network, is in the limelight due to the chaos at Twitter. Its user base has grown from 300,000 in October to 2.5 Million in November.

Twitter’s latest restrictions on posting Mastodon links led more journalists, key opinion leaders and jet trackers to move to Mastodon.

The FOMO created by Randy Fishkin’s blog post on ten reasons why all marketers should join Mastodon today led me to join up on one server instance, and I was lost.

This tweet explains my feelings better than I ever could.

Volunteer-run, federated servers dependent on donations are not the fastest to scale up. With larger companies such as Mozilla, Firefox and Tumblr taking an interest in setting up federated social media, the productisation & potential monetisation of these nascent networks are pretty close.

Keep an eye on this one in 2023.

That's it for this week's newsletter. It is good to be back to writing. If you enjoyed any particular article today, please let me know.

If you enjoyed the newsletter today, why not share it with your friends and colleagues?